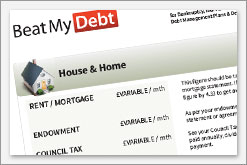

If you are applying for a Debt Relief Order (DRO) you will need to complete a living expenditure budget as part of your application. This is a list of all of the reasonable living expenses that you incur every month.

If you are applying for a Debt Relief Order (DRO) you will need to complete a living expenditure budget as part of your application. This is a list of all of the reasonable living expenses that you incur every month.

- An accurate living expenses budget is vital

- Get a free copy of our Living Expenses Guide

- How to use the Guide

Debt Solutions Living Expenses Guide

If you have a debt problem you will need to complete a living expenses budget. What types of expenditures are allowed in your budget? Where can you get a guide to your allowable living expenses? To find out more please visit http://beatmydebt.com/self-help-guides-resources/living-expenses-guide

Completing an accurate Living Expenses Budget is vital for a DRO

It is very important to get your Living Expenses Budget right. The expenses you record in your Debt Relief Order application will be used by both your authorised debt counsellor and the Official Receiver to work out your disposable income.

If your Disposable income is more than £50 a month you do not qualify for a DRO.

If you underestimate the amount you spend on any of your living expenses or forget to include some your total budget will be too low. Your disposable income will then be incorrectly calculated and will be too high.

If your disposable income is more than £50 per month because your living expenses have been underestimated it will look as though you do not qualify when really you do.

Get a Free Copy of our DRO Living Expenses Guide

Our Living Expenses Guide gives a comprehensive list of the expenses you should include in your monthly budget.

The guide also gives recommendations regarding the amounts that you will have to stay within to ensure that they are acceptable to your debt counsellor and the Official Receiver.

The guide is free. To get a copy click the “Download Living Expenses Guide” button at the top right of this page (or at the bottom if you are using your mobile).

How to use the Debt Relief Order Living Expenses Guide

The Guide MUST be used for guidance purposes only. Every individual’s situation is different. The acceptable figures in each category may be higher or lower than those indicated depending on your circumstances.

Some of the figures stated in the Guide may seem restrictive. However they are known to be generally accepted by the Official Receiver. If you want to apply for a Debt Relief Order you must be prepared to live within a restricted budget

If you feel that you need to spend more than the recommended amounts you should always include these figures in your budget.

You must be prepared to justify any additional expenditure you include. You should understand that you might be asked to reduce these if they are not acceptable.

Arrange a call with a Debt Management Expert

Privacy Policy

Your information will be held in strictest confidence and used to contact you by our internal team only. We will never share your details with any third party without your permission.