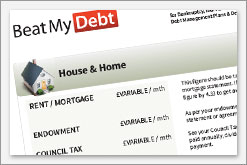

If you are considering a debt solution you will need to complete a living expenditure budget. You can get a fee copy of our debt management living expenses guide here.

Jump to article content:

Rather speak to a person? Call 0800 077 6180 or fill in the form below and we’ll call you

Debt Solutions Living Expenses Guide

If you have a debt problem you will need to complete a living expenses budget. What types of expenditures are allowed in your budget? Where can you get a guide to your allowable living expenses? To find out more please visit http://beatmydebt.com/self-help-guides-resources/living-expenses-guide

Why do your Living Expenses need to be correct

If you want to use a debt management solution it is very important to get your Living Expenses Budget right. The total of your expenses will be used to calculate your disposable income. This is the amount you will state you can afford to pay towards your debts each month.

If you underestimate the amount you spend on any of your expenses or miss some out completely your total expenses budget will be too low.

If you use a living expenses budget which is too low the amount you work out that you can pay towards your debts will be over estimated. You will then struggle to maintain the payments. Our living expenses guide will help you get your budget right.

Get a Free Copy of our Living Expenses Guide

The Living Expenses Guide gives a comprehensive list of the expenses you should include in your monthly budget.

The guide also recommends the expenditure limits that you should stay within to ensure that they are acceptable to your creditors. This will increase the chance of your debt solution being accepted.

The guide is free. To get a copy click the “Download Living Expenses Guide” button at the top right of this page (or at the bottom if you are using your mobile).

How to use the Living Expenses Guide

The Guide MUST be used for guidance purposes only. Every individual’s situation is different. The acceptable figures in each category may be higher or lower than those indicated depending on your circumstances.

Some of the figures stated in the Guide may seem restrictive. However they are known to be generally accepted by banking creditors. If you want to apply for a debt solution you must be prepared to live within a restricted budget

If you feel that you need to spend more than the recommended amounts you should always include these figures in your budget.

You must be prepared to justify any additional expenditure you include. You should understand that you might be asked to reduce these if they are deemed to be unacceptable.

Arrange a call with a Debt Management Expert

Privacy Policy

Your information will be held in strictest confidence and used to contact you by our internal team only. We will never share your details with any third party without your permission.