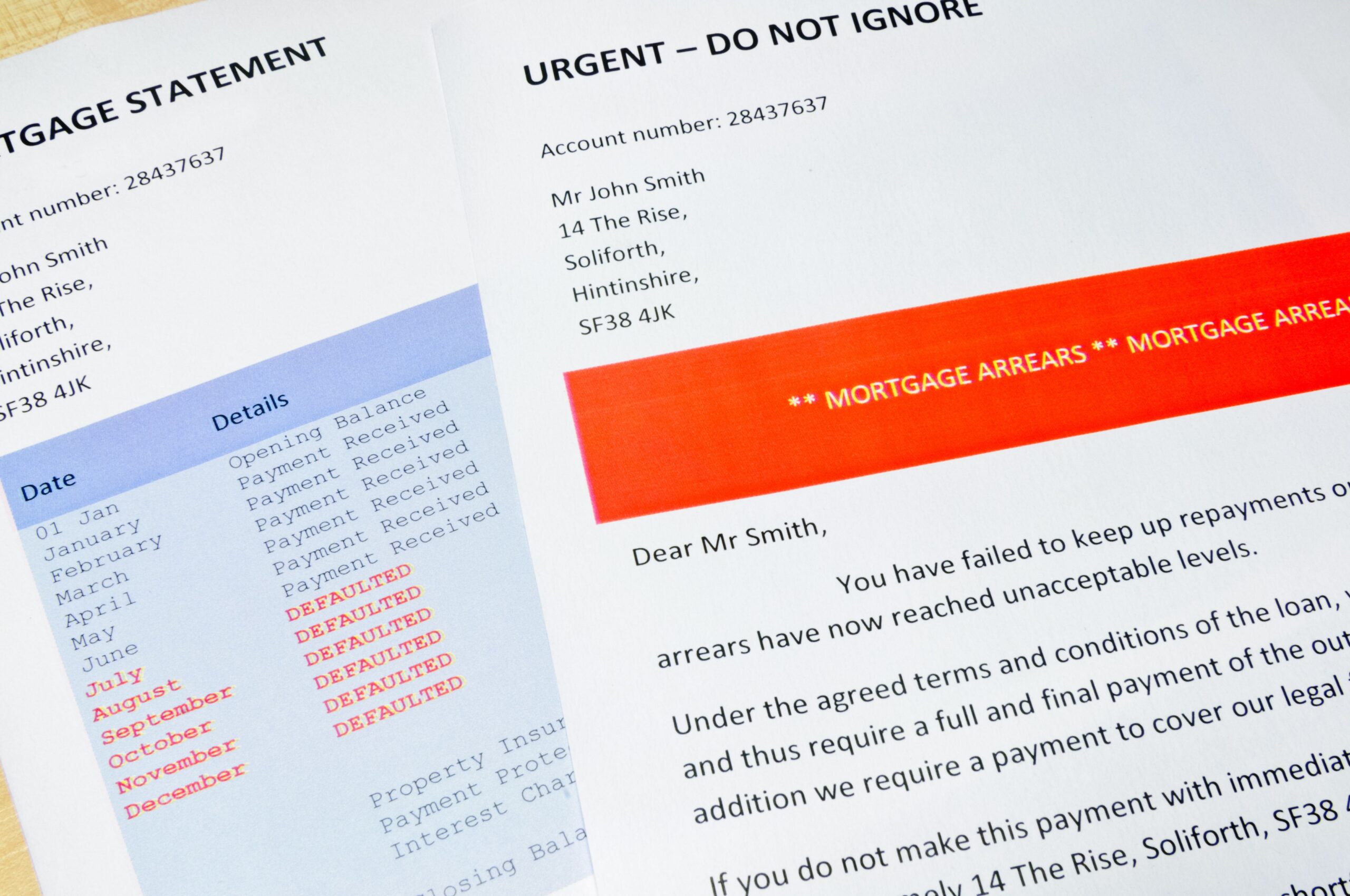

If you are struggling to pay your mortgage and mortgage arrears have built up, your home could be at risk of repossession. This article gives advice about how to get your arrears under control and protect your property.

Included in this article:

- How can debt management help pay mortgage arrears?

- Can your lender reduce your mortgage payments?

- What happens if you simply can’t pay your mortgage?

Struggling to pay your mortgage? Give us a call (0800 077 6180) or complete the form below. The advice is free and confidential.

How can debt management help pay mortgage arrears?

You can’t include mortgage arrears in a debt management plan. However a common reason for getting into mortgage arrears is where your other unsecured debts have got out of hand.

Where you are struggling to keep up with your credit cards and personal loans, these can start to take priority over your mortgage payments. In this situation, a debt management solution can help you get back in control.

Given you are a home owner, the best options to consider will be either a debt management plan or IVA. Implementing either of these solutions will mean you can significantly reduce your monthly unsecured debt payments.

The money you free up can then be used in two ways. First, you should always have sufficient funds in your living expenses budget to meet your normal mortgage payment going forward. Second, some of your surplus income can be used to overpay your monthly mortgage and start to reduce the arrears.

A debt management solution will only work if the surplus income it frees up is sufficient to sustain both the solution and an overpayment on your mortgage to reduce the arrears.

Can your lender reduce your mortgage payments?

Another option if you are struggling to pay your mortgage is to get help direct from your lender.

Since 2009, mortgage lenders have been obliged to operate under a set of Government imposed guidelines known as the Pre-Action Protocol. This gives strong recommendations about how they should work to help customers who are struggling to pay their mortgage.

Lenders should consider if they can make your mortgage payments more affordable in the following ways:

1. Change your mortgage to an interest only product. This will have the effect of reducing the monthly cost of the mortgage. However, you must also remember that at the end of the mortgage term, the mortgage will remain outstanding.

2. Increase the period of time over which the mortgage is paid. This would mean paying more interest in the long term but would reduce the monthly payments that you make.

3. Reduce your monthly interest payments. Your lender may be able to offer reduced interest rate payments if you are struggling with your mortgage payments but show a willingness to stick to a repayment plan.

Your mortgage lender is not legally obliged to offer any of the help suggested within the Pre Action Protocol. You may still have to support any assistance they can provide by reducing your other debts with a debt management solution.

What happens if your simply can’t pay your mortgage?

Ultimately, if you can’t pay your mortgage and are unable to agree a plan to repay any arrears, your lender has the right to repossess your property. In these circumstances, you may have to make the hard decision to leave your property.

Where you have equity, you have the option to sell. You could then buy a smaller property with a more affordable mortgage. Alternatively, move into rented accommodation.

But what if you are unable to sell. Perhaps because you have negative equity?

In these circumstances, you could actually walk away from the property without selling. This is known as voluntary repossession. It involves you moving out into rented accommodation and handing the keys back to the mortgage lender.

Your mortgage lender will then sell the property so that the outstanding mortgage is repaid. Once this process is completed, you will remain personally liable for any part of the mortgage which was not paid (known as a mortgage shortfall). However, because this debt is then unsecured, there are various options for dealing with it including an IVA or even going bankrupt.

Got a problem with mortgage arrears? Give us a call (0800 077 6180) or complete the form below. The advice is free and confidential.

Arrange a call with a Debt Management Expert

Privacy Policy

Your information will be held in strictest confidence and used to contact you by our internal team only. We will never share your details with any third party without your permission.